Planning your next farm equipment purchase? Whether you intend to buy, finance or lease, you may be qualified to take advantage of substantial tax savings under Section 179 again this year.

Here’s your guide for navigating Section 179, bonus depreciation and other bottom-line enhancing tools in 2024.

Qualifying purchases

Using the Section 179 deduction, you can write off the entire purchase price of qualifying equipment up to the deduction limit. In recent years, qualifying equipment was expanded to include both new and used equipment. This definition of qualifying property remains in effect for 2024.

In addition to equipment purchases, other eligible items may include “off-the-shelf” computer software, breeding livestock, and single purpose structures, such as milking parlors.

Deduction limits

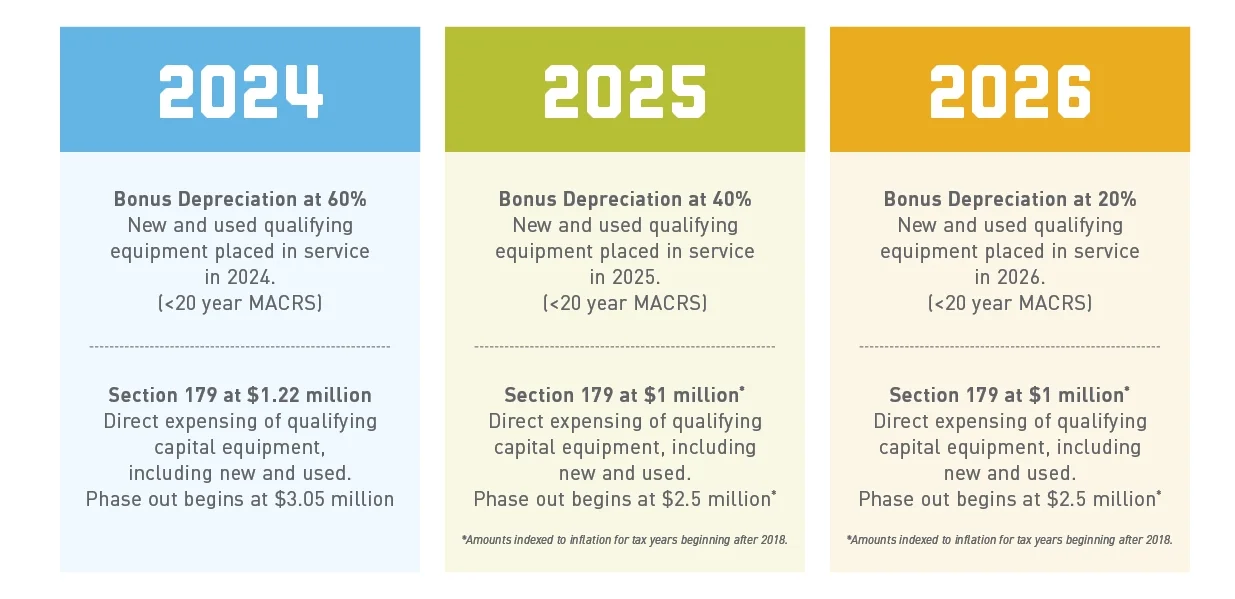

The Section 179 deduction limit for 2024 was raised to $1,220,000 with a capital purchase limit of $3,050,000. This is an increase from the 2023 Section 179 tax deduction which was set at a $1,160,000 limit with a threshold of $2,890,000 in total purchases.

Bonus depreciation

Bonus depreciation, which is generally taken after the Section 179 spending cap is reached, will continue to phase down from 80% in 2023 to 60% in 2024. For example, a $100,000 piece of used equipment would get $60,000 of bonus depreciation in 2024 with $40,000 being depreciated over a seven-year period.

Bonus depreciation will continue to drop according to the following schedule:

• 40% for property placed in service in 2025

• 20% for property placed in service in 2026

• 0% for property placed in service in 2027 and later years

With these changes to bonus depreciation on the horizon, it’s important to have a plan in place to address how this will not only impact equipment spending in the 2024 tax year, but also future machinery purchases going forward.

Advantages of leasing equipment with Section 179

Leasing continues to be an effective tool for lowering payments and preserving cash and credit lines. From a tax perspective, two of the most popular types of leases are a true tax lease and a conditional sales lease.

By opting for a true tax lease, you can avoid the diminishing benefit of Section 179 and take advantage of a consistent write-off over the course of the lease rather than expensing 100% in the first year only.

In contrast, a conditional sales lease enables you to take depreciation just like a loan while benefitting from a lower lease payment, making it an attractive option if you’re looking to enhance cash flow.

AgDirect offers both true tax leases and conditional sales leases to meet your various needs and unique tax situation.

Impact on equipment costs

The potential savings from Section 179 can have a significant impact on your equipment costs. If you’re considering an equipment purchase in the current tax year, you can estimate those savings using the 2024 Section 179 Tax Deduction Calculator.

For example, a $200,000 tractor coupled with Section 179 can reduce the true cost of the purchase to $130,000, freeing up $70,000 in cash savings. This sample calculation assumes a tax bracket of 35%.

The calculator provides a potential tax scenario you can use to gauge the various ways Section 179 can impact your bottom line. Talk to your tax advisor to determine how the indicated tax treatment applies to your equipment purchase.

Other takeaways

Although tax incentives like Section 179 and bonus depreciation can be beneficial, these provisions should only be used in situations that make long-term financial sense for your operation. That’s why it’s important to always consider your tax circumstances and cash-flow requirements when using these tools.

Before making any large capital purchases, it’s a good idea to consult with an accountant or tax adviser to ensure deductions are claimed according to the Section 179 code. Keep in mind not all states conform with federal increases to expensing limitations or the federal treatment of bonus depreciation provisions.

To learn more about financing and leasing equipment with Section 179, contact your nearest AgDirect territory manager or the AgDirect Finance team at 888-525-9805.