Used machinery on a dealer’s lot can be a good thing when buyers are looking to fill specific needs, but when that inventory grows beyond demand, it can become costly in a hurry for any dealership.

Avoiding excess used inventory takes a long-term approach based on a firm grasp of both used and new inventory, and understanding how that inventory cycles as buyers trade. A “washout cycle” is a strategy that works through lower-value used inventory that can help some dealers move surplus machines in a way that sustains sales into the future, according to Casey Seymour, Remarketing Manager for Prairieland Partners in Hutchinson, Kansas and originator of the washout cycle idea. And, when a dealer initiates a washout cycle, it yields unique buying opportunities for farmers.

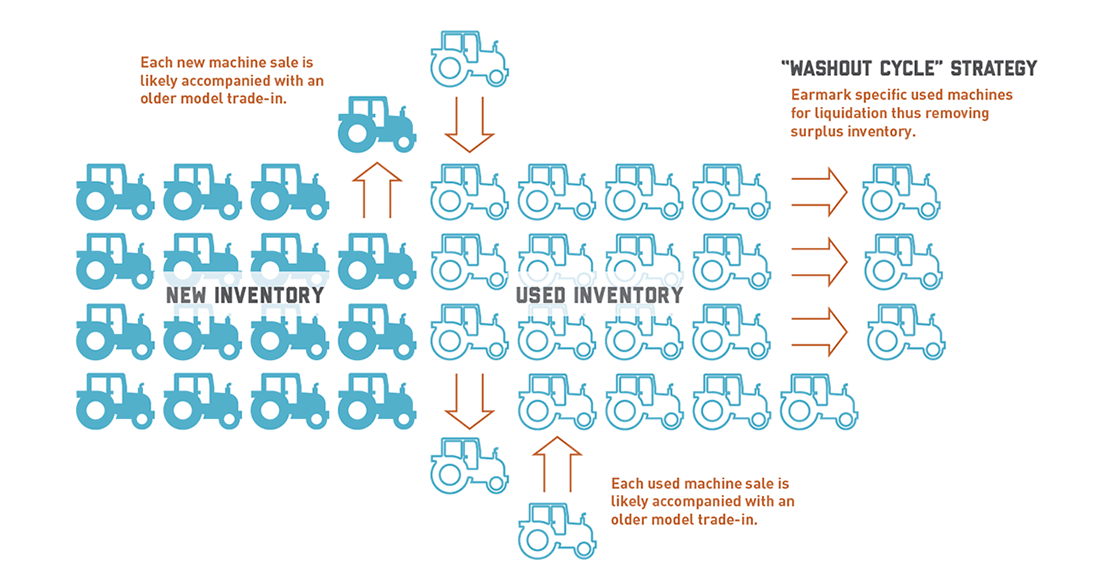

When employing a washout cycle strategy, Seymour says, a dealer earmarks specific used machines for liquidation to prevent the cost of unsold used machines on the lot chipping away at their bottom line. It requires attention to specific inventory – and how that inventory cycles as dealers take on used machines via trade-ins -- in order to be successful.

Almost every machine on a dealer lot – be it tractor, combine or implement – represents a potential sale that will likely be tied to a trade-in. The cycle of trade-ins leads to a gradual build-up of used inventory with increasingly older units until the last one is purchased without a trade.

The need for a washout cycle

Seymour developed the washout cycle strategy after watching a dealer's used inventory start to balloon, causing a decline in profitability because of the increased value of unsold units and costs of retaining higher numbers of lower-value machines. He saw the need to find a way to liquidate some of that inventory.

“I started looking at all of these used combines being traded in that were causing the value of our inventory to increase,” Seymour says. “We had all of these new and used machines, but were constantly playing catch-up to sell them and get our inventory value down."

What you need to know to get started

Ending that game of catch-up starts with knowing how many new units need to sell to be profitable, and knowing how many used machines need to sell as a result of new sales.

“If a dealer is selling new tractors and combines and they have no idea what their average used sales are, they’ve already created a problem that can’t be solved. A dealer has to know what their new and used sales goals are, because not only does this affect what is being brought in on trade, but what winds up in total inventory," Seymour says. "It’s really important to first know how many new machines you sell each year, then how many used units you need to work through as a result of those new sales."

That inventory picture is not as simple as basic used numbers. Once the used sales that are needed to sustain are known, it’s important to consider the overall “churn” of used equipment. When a new machine leaves the lot, a used machine typically takes its place. When that machine sells, an even older one takes its place and the cycle continues until the last, oldest machine is sold without a trade-in. Ultimately, it means for every new machine sold, more than one used unit must be sold in order to maintain a balanced inventory.

“If you already have 15 or 20 combines in your inventory, depending on where they’re at in this cycle, you could have 60 used combines to sell,” Seymour says.

Starting your washout cycle

Those kinds of numbers may seem daunting to the dealer, but the good news is there is a clear path to alleviating the pressure of mounting lower-value used inventory levels. "Washing out" used machinery may mean selling at a lower price, but it can pay off in the long-term by eliminating the cost of maintaining higher used inventory.

“You’re ultimately going to limit your risk by liquidating those used machines,” Seymour says. "Work through what you can work through. I would never in a million years recommend putting 40 combines at one auction. If you took three or four every month and sprinkled them out and try to maximize your dollars, that’s the best way to do it,” Seymour says. “It can even be as simple as taking these four combines and saying ‘We’re going to sell for this price.’ You have to be open to all the options. It can be as simple as we’re going to put really cheap prices on these machines. But, you can be creative and employ rental or lease options.”

Opportunities for farmers

A dealership washout cycle has benefits to farmers looking to secure machinery at a lower cost. The units marked for liquidation in the cycle will have much lower price tags, and with the right resources devoted to washing out those units by the dealer, the farmer stands to have buying opportunities that can help trim overall machinery costs.

“We want to limit the number of machines in a washout cycle to a specific number of units based on what each individual dealer needs to sell in order to maintain a balanced inventory,” Seymour says. “As a dealer, it’s going to be worth the time and effort to move those units. And, that’s where the opportunity lies for farmers.”

If you're in the market to buy used machinery and wonder whether a nearby dealership is employing a washout cycle, there are a few key signs. It starts with an understanding of the dealership itself. Size can sometimes be an indication of liquidity. If you feel a dealership has the size and inventory to be able to work through a washout cycle, it is a good time to check used inventory prices for any potential sales that may be part of that process.

"It's really about what a dealer's appetite is and what they can sustain. Those who are super liquid can take a larger loss, while some can't take any losses at all and don't have the cash on hand to work through a washout," Seymour says. "It's really a dealership-by-dealership thing."

Another key thing to watch is new machinery inventory. If a dealership has a lot of used units on the lot and takes on a wave of new machines on top of that used inventory, it could foreshadow the need to liquidate used units. If a washout cycle is employed to do that, it could mean lower prices for the buyer.

"It really depends on the sale of new equipment and what manufacturers do. There's always going to be pressure to sell new inventory," Seymour says. "The opportunity for farmers comes when dealers go to the effort to sell these specific used machines to make room for the new inventory that the manufacturer expects the dealer to sell."

Learn more

If you’re an ag equipment dealer who wants to learn more about how to employ a washout cycle, contact Casey Seymour by phone at 620-960-0084 or by email at casey.seymour@movingironllc.com. You can also learn more by attending his session at the Farm Equipment Dealership Minds Summit 2017 on Tuesday, August 1, 2017, in Omaha, Nebraska.

If you’re an ag producer in the market for used machinery, AgDirect has financing options for purchases at the dealership, auction or with a private party. We’re dedicated to agriculture and offer many financing options to fit any operation, whether buying used or new machinery. We offer financing for buying, leasing or refinancing, with fixed- and variable-rate terms from two to seven years. We also offer delayed payment plans with no prepayment penalties.

Want to learn more? Contact your nearest AgDirect representative.