Working capital is one of the most useful indicators of an operation’s financial health. As a calculation of current assets minus current liabilities, it’s also an important risk management tool during downward market swings.

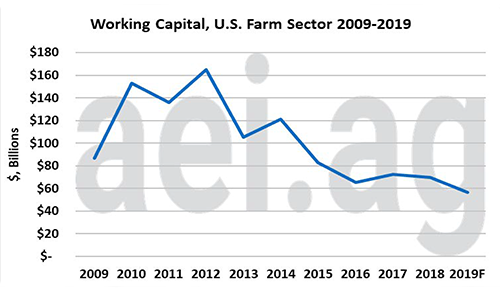

“Back in 2012, U.S. farm working capital was over $160 billion,” says Dr. Brent Gloy, a farmer and economist specializing in agricultural finance and business management. “Today that number has plummeted to around $60 billion. That’s a huge decline in cash available within the agriculture sector.”

Despite challenging economic conditions, there are three steps you can take to improve your working capital position and rebuild cash reserves. These strategies include selecting a benchmark, monitoring trends and setting goals.

Selecting a benchmark

“There are many different ways producers can measure working capital,” says David Widmar, an agricultural economist focused on trends and data-driven insights. “The first step is finding a benchmark that works best for your operation.”

Examples include total dollars, gross revenue, dollars per head, dollars per acre or the ratio of current assets and current liabilities.

“Don’t get overwhelmed with the nuances of which benchmark to use,” advises Widmar. “The important thing is to take a step back, have a conversation with your lender and financial partners, and focus on one metric that you can easily measure and monitor.”

Widmar also recommends taking into account the risks associated with price changes and asset valuation.

“When we factor in commodity prices we often think about downside or upside potential, but we don’t always consider the balance sheet implications,” he explains. “It’s important to remember that one dollar of working capital tied up in cash or a savings account is not the same as working capital tied up in unpriced grain or livestock.”

Monitoring trends

The next step in managing farm assets and liabilities is to identify sources of working capital in your operation and how those sources have trended over time.

The next step in managing farm assets and liabilities is to identify sources of working capital in your operation and how those sources have trended over time.

“If you haven’t already tracked your metrics, you can pull out your old farm records and replicate numbers from your balance sheet,” says Widmar. “Once you have an idea of whether the trend is flat, up or down, it’s beneficial to look at changes in working capital from year to year.”

According to Widmar there are two variables producers should consider – burn rate and gain rate. While burn rate refers to the amount of working capital expended in a year, gain rate represents capital acquired.

“Keeping an eye on trend lines and rates of change can tell you how much flexibility or risk absorption you have in your operation,” says Widmar. On the other hand, it can give you an idea of what’s feasible if you have plans to expand.”

“Profits and losses, family living expenses and non-current assets such as machinery or farmland are often three major sources of change,” he adds. “As a farm manager the key is striking a balance between building working capital and determining it’s best use.”

Setting goals

“The third step in managing working capital includes setting goals and establishing a plan based on your farm’s specific needs,” says Widmar.

Start by asking yourself what a reasonable level of working capital is for your operation. The following factors may influence your answer:

- What percentage of my farmland is owned vs. rented?

- How do individual enterprises, such as irrigated land or livestock, affect my operation?

- Who are the key decision makers? What are their spending and saving preferences?

- What upcoming changes will there be in my operation? Is there an opportunity for expansion or bringing in the next generation?

“It’s also a good idea to work with your lender, understand their expectations and determine whether your goals can be met within a reasonable timeline,” Widmar says.

For example, making an equipment purchase is one scenario where your ag lender can play an important role in developing a workable plan for managing your working capital.

“Machinery purchases typically reduce short term assets and increase current liabilities depending on the payments you’ll be making on that piece of equipment,” says Mary Anne Mullen, vice president of AgDirect Credit.

“At AgDirect, we strive to be a resource rather than a gatekeeper when it comes to helping producers understand the impact of the decisions they are making,” she says. “That includes talking through what strategies have proven successful for other producers and determining what financing options are the right fit for your operation.”

Learn more about AgDirect financing and how an equipment purchase can impact your working capital position by locating your nearest AgDirect territory manager or contacting the AgDirect financing team at 888-525-9805.